Sonata Software Ltd: Pioneering Innovation and Delivering Stellar Returns in IT Services

Company Overview

Sonata Software Ltd. is a leading global IT services and technology solutions company based in India. It provides a wide array of IT services, software solutions, and digital transformation offerings to enterprises worldwide. With a focus on innovation and customer-centricity, the company caters to industries such as retail, manufacturing, travel, ISV (Independent Software Vendors), and BFSI (Banking, Financial Services, and Insurance). It has business segments in IT services, platformation, Product Engineering, and software Distributors. It has a global presence with operations in over 35 countries, serving more than 500 clients.

Return Summary

| YTD | 1 Month | 6 Month | 1 Year | 2 Year | 3 Year | 5 Year |

| (15.73%) | 4.75% | 15.07% | (0.15%) | 113.87% | 111.02% | 444.02% |

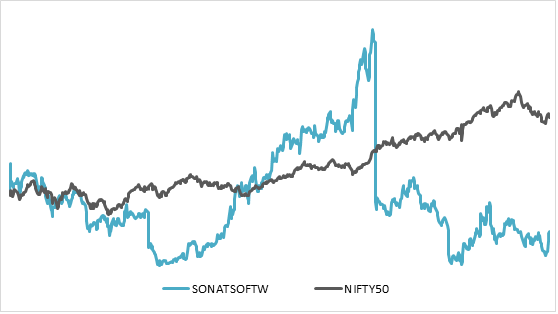

3 Year Return: Sonata Software v/s NIFTY

Result Highlights

- Revenue for YoY and QoQ is at increasing phase at Q2 FY25 revenue of ₹2527 crore with moderate EBITDA margin of 7% at ₹176 crore.

- The target revenue company want to achieve is ₹12,000 crore by the end of 2027, and strengthening its client partnerships with Microsoft, AWS and other significant players.

- In this half year company has closed 6 large deals, and in active pipeline 49% are large orders.

- The cash reserves on balance sheet has reduced from ₹700 crore to ₹500 crore, because of dividend payouts and acquisitions.

- Major wins in Q2 are Collaboration with a US technology giant for AI, cloud, and data services. A multi-year data modernization program with an Australian wholesaler. Strategic partnership with a leader in food safety systems for consumer-facing automation platforms

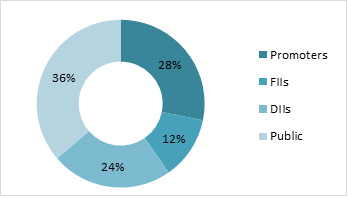

Shareholding Pattern

Return Comparison with Peers

| COMPANY | 1 Year | 2 year | 3 Year | 5 Year |

| Sonata Software | (0.15%) | 113.87% | 111.02% | 444.02% |

| Tata Elxsi | (19.7%) | (1.86%) | 14.26% | 734.5% |

| KPIT Technology | (8.12%) | 91.47% | 196.3% | 1341.6% |

| Newgen Software | 75.56% | 560.6% | 319.2% | 1176.5% |

| Birlasoft | (3.44%) | 97.15% | 25.32% | 745.02% |

Contribution to Industry Size

The great partnership for 30+ years of Sonata with Microsoft in the AI industry has helped Sonata grow significantly. It is helping Microsoft with 400+ clients across the globe generating Microsoft’s $650+ million revenue per annum. It has 3500+ teams on Microsoft Technologies, contributing in the industry of healthcare, retail, manufacturing, and Telecom. For corporates, it has made its own AI called Harmoni. AI with Microsoft and AWS as partners.

Balance Sheet Analysis

- Reserves have been increasing gradually with high revenues and efficient management operations.

- Borrowing has increased year on year to fulfil the expansion and partnerships with clients for projects.

- The cash reserves are enough to pay the borrowed debts and acquisitions of companies to grow inorganic way.

- The balance sheet is strong and efficient in industry aspects.

Cash Flow Analysis

- Cash flow from operations is ₹281 crore in FY24 and is positive for many years.

- The acquisitions have increased in the past 2-3 years because of high demand in the industry, showing great strength in the company.

- The borrowing has been stable and is very low, maintaining its debt-to-equity ratio.

- The company is paying its dividend every year constantly with good payouts to its investors.